Koramic Investments is a Belgian family office. Based on our long-term strategy, we manage a diversified portfolio of participations and investments in various sectors and regions/countries and no single activity dominates. That allows us to achieve growth, spread risks and create sustainable value for future generations.

ESG stands for three important pillars of a company, namely the environment, people and good governance, to which our group pays the greatest attention. Via our ESG strategy, we work on sustainable development as well as on our social responsibility and the way our companies are governed.

In addition, philanthropy is also an important part of Koramic’s and its shareholders’ strategy. We support diverse projects in several areas.

Our multidisciplinary management team can draw on its many years of experience in entrepreneurship. Koramic has a strong financial structure and our distinctive strategy and financial strength enable us to develop new initiatives and enhance our portfolio through majority stakes in companies, real estate, private equity and capital markets.

Since Koramic’s inception in 1883, we are passionate entrepreneurs and we strive to excel in everything we do. With foresight, we develop a long-term vision that guides our decisions and investments.

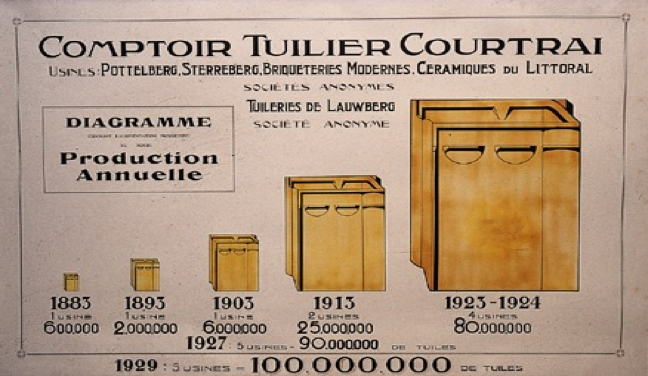

The origins of Koramic Investments date back to 11 September 1883, when the public limited company Dakpannenfabriek Pottelberg was founded in Kortrijk. It was the first industrial producer of ceramic roof tiles in Belgium and has always remained the parent company of the Koramic group.

Together with its sister companies, Dakpannenfabriek Pottelberg formed a consortium named Kortrijks Dakpannenkantoor – Comptoir Tuilier de Courtrai. Under the impetus of Ernest Dumolin, a prominent industrialist from the Kortrijk region, it developed into the most important group for roof tile production in Belgium. In the 1920s, the group experienced substantial growth and employed 2.000 people in the Kortrijk area. The Pottelberg-Sterreberg ceramic roof tiles gained great fame and were sold worldwide. In addition to roof tile production, Ernest Dumolin developed a wide range of other activities and owned, among others, a bank, a textile factory, a printing company, a furniture company, a bicycle factory etc.

After the Second World War, the Kortrijks Dakpannenkantoor experienced a significant slowdown in its activities. Due to the emergence of competing products, the production of ceramic roof tiles fell from 100 million pieces before 1940 to about 20 million at the end of the 1970s. In the 1960s, the Kortrijks Dakpannenkantoor started producing prefab concrete elements, and changed its name to Koramic in 1968. The production of prefab concrete elements became the main activity of the group. At the end of the 1970s, Koramic had 1.200 employees and a turnover of about 1.4 billion BEF and an equity of 100 million BEF.

In 1980, Christian Dumolin, grandson of the group’s founder, gained control of the company through a leveraged buyout. Faced with a severe crisis in the Belgian construction sector, the new management restructured the company drastically. The group significantly scaled back its existing activities and the production of prefab elements was completely stopped. The group shrunk to 2 roof tile factories in Kortrijk. Employment fell from 1.200 to 600 people, while turnover halved from 1.2 billion to 600 million BEF.

The economic downturn was a huge challenge, but also created important opportunities. The management team developed a strategic plan, focussing on internal growth through continuous investments in existing or new production units and aiming for external growth through the acquisition of complementary companies. The group progressively developed its brick activities under the name Terca. In 1985, the group acquired the Narvik roof tile factory in the Netherlands, its first investment abroad. Sales increased to 2.5 billion BEF during that period. Parallel to its expanding activities in building materials, Koramic started diversifying beyond the sector of building materials. Christian Dumolin and Albert Tuytens founded Indas (Industry Associates nv) in 1985, together with a number of other Flemish industrialists. It was one of the first Belgian venture capital companies and also the start of Koramic’s private equity activity. During the same period, Koramic also took its first steps in the real estate sector through its Korimco company. In 1991, the parent company of the group changed its name to Koramic Ceramic Holding (KOCERAM in short).

1994 marked a milestone in the history of the Koramic group by merging its Terca brick activities with those of the English Redland group under the name Terca Brick Industries. Terca Brick Industries was listed on the Brussels Stock Exchange on 13 June 1994 and had a total of 34 production units.

A second milestone followed in 1996 with the buyout of Redland’s stake in Terca Brick Industries, after which the Koramic group transferred all its activities in building materials to the listed Terca Brick Industries. It changed its name to Koramic Building Products and owned 50 production units.

At the same time, Koramic transferred its brick activities to the important Austrian Wienerberger building materials group. Koramic Building Products, together with the Austrian Creditanstalt bank, acquired control of Wienerberger.

In 1998, Koramic’s private equity activities were listed on the Brussels Stock Exchange under the name TrustCapital Partners.

In 2000, Koramic had a turnover of 1.3 billion EUR and employed around 9.800 people. In the same period, Koramic further expanded its activities in real estate and private equity.

During this period, Koramic Building Products decided to review its strategy and reduce the size of its building materials business and develop new activities. This was done, among other things, by the transferring Koramic’s roof tile activities to Wienerberger and the progressive transformation of Wienerberger into a free float company.

In 2005, the Koramic strategy change was completed by transforming Koramic Building Products, an industrial group in building materials, into Koramic Investment Group, an industrial and financial holding company. At the same time Koramic Building Products was transformed into a private company and delisted from the Brussels Stock Exchange. Also TrustCapital Partners was delisted.

On 11 September 2023, Koramic celebrated its 140th anniversary, making it one of the oldest public limited companies in the country.

To prepare the Koramic group for the future and the next generations, it will be transformed from an industrial holding company into a family office, i.e. a family-controlled company run by professional management. The activities remain the same and so does our connection to Kortrijk.

In order to mark the new strategy, Koramic Holding has been renamed Koramic Investments and a new logo has been designed. The green touch in the logo symbolises positivity, creativity, growth and development.

It also refers to the link between people and nature, both of which are fundamental to our group.